Why Offering a Retirement Plan Feels Necessary Yet So Difficult

By: Jasmin Sethi, CEO, Sethi Clarity Advisers and Alexander Pappas, Consultant and Chief of Staff, Sethi Clarity Advisers

For many small business owners, offering a retirement plan is both a practical and values driven decision. A plan can help attract and retain employees, support long-term financial security, and signal that the business is invested in its workforce. Owners themselves often want a structured way to save for retirement beyond personal IRAs; yet despite these motivations, the process of choosing a plan can feel overwhelming. The retirement system is fragmented across providers, plan types, and regulatory rules, and much of the information that truly matters is difficult to evaluate at the outset. Knowing where to begin is often the biggest hurdle.

The Illusion of Transparency in Retirement Plan Shopping

A quick online search produces no shortage of options. Providers prominently advertise 401(k) plans, SIMPLE IRAs, SEP IRAs, and newer pooled arrangements. Comparison articles list dozens of companies that claim to specialize in small business retirement plans. From the outside, it appears that the market is competitive and transparent, with many choices available.

It is also relatively easy to find high level explanations of how different plan-types function. Educational pages explain contribution limits, basic tax treatment, and eligibility rules. Many providers offer glossaries and introductory guides that describe how employee deferrals work, what employer matching means, and how accounts are invested over time. This information is helpful and necessary, but it only scratches the surface and overloads small business owners with too much information.

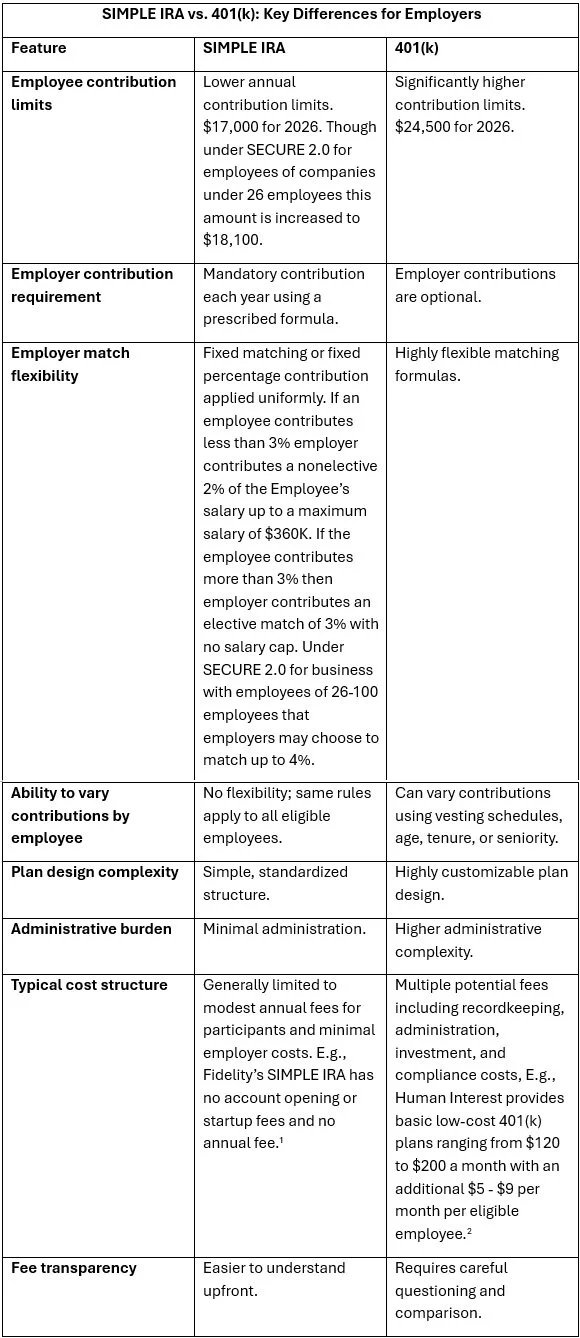

For example, many small employers find themselves deciding between a SIMPLE IRA and a 401(k), a choice that appears straightforward but quickly becomes nuanced. A SIMPLE IRA offers lower contribution limits and requires the employer to contribute using a prescribed matching or fixed formula that applies uniformly to all eligible employees. The appeal is clarity and affordability: costs are typically limited to modest annual fees for participants and minimal employer administration, making expenses easier to understand upfront.

By contrast, 401(k) allows significantly higher contribution limits and far greater flexibility in plan design. Employers can vary match percentages, introduce vesting schedules, or structure contributions differently based on tenure, age, or seniority. That flexibility can support long-term growth and evolving business needs, but flexibility comes at the cost of simplicity. A 401(k) often involves multiple layers of fees, including recordkeeping, administration, investment expenses, and compliance-related costs. 401(k) plans thus require more consideration and research when shopping for a plan than SIMPLE IRAs.

The practical implication of this distinction becomes clear when owners consider their own savings goals. Suppose a business owner wants to contribute well above the SIMPLE IRA limit in a given year. In that case, a SIMPLE IRA simply does not provide the necessary capacity. Even if the plan is otherwise attractive, the statutory limits force the owner to look toward a 401(k), where higher employee deferral limits and additional employer contribution options make larger total contributions possible. The administrative complexity and higher costs may be worth accepting in exchange for the ability to save more aggressively and design a plan that grows alongside the business.

However, many small business owners may be focused on stabilizing cash flow, reinvesting in the business, or simply getting started with any formal retirement structure. If the owner cannot realistically imagine contributing above the SIMPLE IRA limits in the near term, and if low-cost predictability and ease of administration matter more than optional features, a SIMPLE IRA can be a rational and effective starting point. The rules are easier to understand, the employer obligations are clearly defined, and the cost structure is typically far more transparent.

This is where many small business owners become stuck. They are often presented with a binary framing that implies a 401(k) is the “real” solution and anything else is a compromise. In practice, the more relevant question is whether the plan aligns with the owner’s current financial reality and decision-making capacity. A SIMPLE IRA that is implemented and used can meaningfully improve retirement outcomes, whereas a 401(k) that feels too complex or expensive may be delayed indefinitely. For many businesses, the choice is not between the perfect plan and an inferior one, but between a workable plan today and no plan at all.