Bridging the Retirement Gap: A Critical Look at Small Business Benefits

By: Jasmin Sethi, CEO, Sethi Clarity Advisers and Alexander Pappas, Consultant and Chief of Staff, Sethi Clarity Advisers

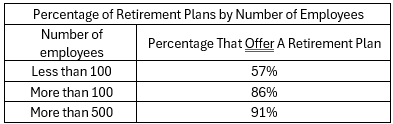

The American economic landscape is fundamentally impacted by small businesses. 34.1% of United States employees are currently employed by small businesses with less than 100 employees in 2025. As of 2023, of small businesses with fewer than 100 employees only 57% offered retirement plans compared to 86% of businesses with over 100 employees and 91% of Businesses with over 500 employees.

This gap creates a significant competitive disadvantage for smaller firms. Fidelity found that 82% of micro business owners (a micro business is a business with fewer than 10 employes) believe they simply cannot compete with the comprehensive benefits packages offered by larger employers.

Financial Barriers to Plan Adoption

The hesitation to implement retirement programs is rarely due to a lack of intent, but rather a complex web of structural and psychological barriers. The most significant hurdle is a lack of resources, as 71% of micro business owners who do not offer a plan feel they cannot afford one. The financial burden of opening and operating a plan represents a substantial drain. Financial constraints are compounded by revenue volatility, which serves as a major deterrent to maintaining a consistent plan. For many small business owners, survival is the primary focus, with 42% of micro business owners reporting that they only earn enough to cover their basic expenses, leaving little room for retirement contributions.

When revenue fluctuates, the commitment to a fixed retirement contribution can feel like a liability rather than an asset. This leads to a state of perceived impossibility. Many owners feel they are not yet financially ready or possess the specialized knowledge required to navigate the complexities of opening a retirement plan.

The Retirement Plan Knowledge Gap

There is a clear knowledge gap regarding the initiation process. Approximately 21% of micro business owners cite not knowing how to begin the process as a primary reason for not offering retirement benefits. Few small business owners are aware of all the resources available to them, and many likely are unaware of The SECURE 2.0 Act of 2022’s enhanced tax credits for small businesses. Businesses with up to 100 employees can claim credits covering 100% of plan start-up costs for three years at a maximum of $5,000 annually. The act also creates a new credit of up to $1,000 per employee to help offset employer contributions for businesses with 50 or fewer employees.

Currently, there is a distinct failure in the market to provide a centralized, simplified platform that addresses these specific challenges for the small business sector. Owners are often overwhelmed by a lack of transparency regarding plan costs, fees, and the appropriateness of various plan lineups. Without a clear starting point or a trusted roadmap, many owners choose to opt out entirely. Research indicates that as of 2023, 55% of micro businesses do not currently offer a plan, nor intend to implement one, likely due to these systemic frustrations.

A Centralized Platform For Retirement Resources

To break down these barriers to retirement plan access, the market requires intervention of a disinterested party. There is a pressing need for a centralized platform that is not geared toward a particular product type, financial brand, or proprietary investment vehicle. This space is ripe for a nonprofit organization, an independent fiduciary, or a government entity to step in and provide a neutral environment for retirement plan education and selection. Such a platform would move beyond the sales-driven models of traditional providers and focus instead on the specific logistical needs of small businesses.

An independent platform would provide the essential resources and education that small business owners currently lack, and by centralizing information on available options like SEP IRAs, SIMPLE IRAs, and Pooled Employer Plans (PEPs), it would close the existing knowledge gap. More importantly, such an initiative would empower owners to feel that offering a plan is not only possible but sustainable. By providing tools to determined contributions and navigate compliance, a neutral platform can help owners demystify the process.Before reaching out for help, small business owners should first identify their specific needs. Whether they require funding, technical know-how, or educational resources, understanding these needs allows them to seek targeted support from the right nonprofit organizations. Additionally, many nonprofits can help guide this process, working alongside businesses to clarify and refine their goals. By addressing these diverse challenges, nonprofits play a pivotal role in helping businesses grow and thrive in a competitive marketplace.